Two-thirds of Europe Planned Battery Production Is at Risk Without Further Action, a New T&E Analysi

Two-thirds of Europe Planned Battery Production Is at Risk Without Further Action, a New T&E Analysis Finds

Two-thirds of Europe planned battery production is at risk without further action, a new T&E analysis finds.

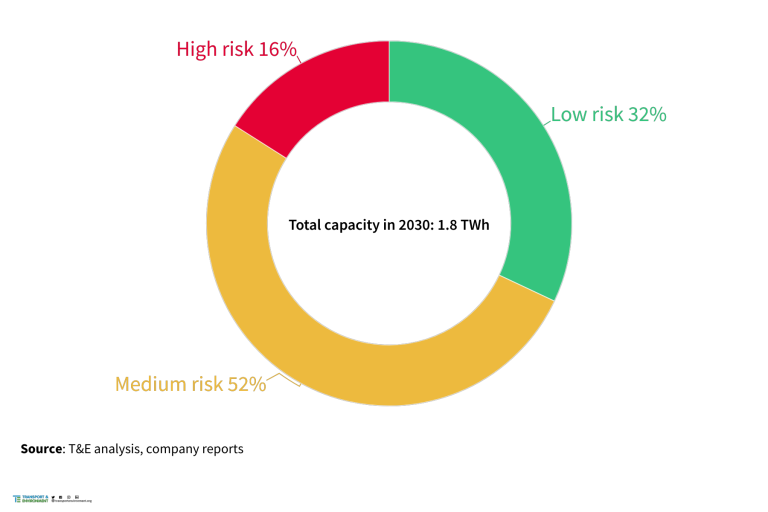

Close to 50 lithium-ion battery factories are planned for Europe by 2030, but US subsidies and other factors pose a new threat to these nascent projects. T&E looked at project maturity, funding, permits and companies’ links to the US to analyse how much of Europe’s 1.8 TWh battery factory potential is at risk.

Almost 70% of European battery cell capacity is at risk

Europe’s leading climate rules, such as the Fit for 55 package, meant the continent has led in global cleantech investments until recently. Dozens of billions have poured into scaling electric vehicle (EV) manufacturing, batteries and component manufacturing. As a result, over half of all lithium-ion batteries (LIB) the EU used in 2022 were already produced locally, with close to 50 gigafactories planned by 2030.

But on top of China’s dominance in EV supply chains, the US Inflation Reduction Act – that pours at least USD 150 bln into batteries components and metals manufactured in the US (or friendly countries) – is changing the rules of the game fast. In terms of global investment into LIB tracked by BloombergNEF, Europe’s share dropped from 41% in 2021 to a meagre 2% in 2022, while investment in China and the US continued to grow.

In theory, one might argue that European and American battery supply chains can develop in parallel and benefit from efficiencies. In practice, skilled workforce, company capital to invest in procurement and permits, and above all supply of raw materials such as lithium, are all in short supply. This means the global race to capture battery manufacturing is in reality more of a zero sum game. Companies from Northvolt, to Polestar to Iberdrola have already signalled expanding in the US.

Using an in-house methodology that looks at project maturity, funding, permits and links to the US, T&E has analysed how much of Europe’s 1.8 TWh battery factory pipeline potential is at risk. The analysis reveals that around a fifth (or 285 GWh) of the announced projects are at high risk, and a further 52% (or around 910 GWh) at medium risk. Overall, almost 70% of the potential battery cell supply in Europe is at risk. The projects might be delayed, scaled down or not realised at all if further action is not taken.